We put excellence, value and quality above all - and it shows

A Technology Partnership That Goes Beyond Code

“Arbisoft has been my most trusted technology partner for now over 15 years. Arbisoft has very unique methods of recruiting and training, and the results demonstrate that. They have great teams, great positive attitudes and great communication.”

How to Deploy Deep Learning for Dynamic Pricing in Travel and Hospitality

Dynamic pricing is already being practiced practically for revenue in the travel industry. For instance, Delta in early 2025 was only powering 3% of its fares with an AI-driven pricing engine. By year-end, the airline plans to push that to 20%, after seeing what it called “amazingly favorable” results in initial tests.

Hotels and other properties adopting AI-driven revenue management have reported up to 18% growth in RevPAR, while many operators cite consistent 12–15% revenue lifts compared to traditional rule-based systems. With 82% of hotel brands already relying on some form of AI for pricing or revenue optimization, the shift has clearly moved past early adoption.

What’s driving this momentum? Demand has become too complex for static models. Customers compare prices across dozens of platforms, local events can flip occupancy within hours, and competitors adjust rates in real time. Traditional revenue management simply can’t keep pace.

So where does deep learning fit into all this? It’s not just another forecasting tool. Unlike traditional models, deep learning can capture the complex, non-linear relationships between demand, price, and context. So, whether that context is a sudden surge of search traffic, a competitor’s flash sale, or a shift in weather patterns. It allows travel brands to move beyond static rules and create real-time, adaptive pricing strategies that reflect the true state of the market. In other words, it’s the engine that makes modern dynamic pricing possible.

For years, revenue management in travel and hospitality meant working with seasonal charts, fare buckets, and static rules. That worked when demand was predictable and competition was limited. But in 2025, the landscape is radically different. Travelers search across dozens of channels, compare prices instantly, and expect offers that match their exact needs. Local events, weather shifts, and global disruptions can change booking behavior within hours. Competitors can respond in real time. Traditional models weren’t designed for this level of speed and complexity.

That’s why market leaders are rethinking pricing. According to The Business Research Company, the global dynamic pricing software market grew to $3.05 billion in 2024 and is expected to reach $3.49 billion in 2025. Adoption is being driven by airlines, hotels, and OTAs investing heavily in AI-powered systems to capture revenue that rule-based models leave behind.

How Deep Learning Helps in Dynamic Pricing?

Hiring the right Deep learning team changes the game because it can handle the complexity that traditional pricing systems can’t. Instead of relying on rigid rules, it learns directly from patterns in massive and varied datasets, and that makes it far better at capturing the reality of modern travel demand.

- First, deep learning models excel at non-linear demand modeling. Price sensitivity isn’t a straight line. A slight price increase might have no impact one week, but trigger cancellations the next if a competitor launches a flash sale. Neural networks can pick up those hidden interactions and adjust accordingly.

- Second, they understand sequence and time dependencies. An airline seat sold six months before departure has a very different value than one sold six hours before boarding. Deep learning models can track those shifts in real time and optimize prices across booking windows.

- Third, they open the door to personalization. By learning from user behavior, loyalty tiers, and booking history, models can suggest rates that maximize both conversion and long-term value.

- Finally, deep learning can integrate unstructured signals like weather updates, event calendars, or even social media trends. These outside factors often drive sudden surges in demand, and Deep Learning models can fold them directly into pricing decisions.

Airlines like Delta have already tested AI systems that adjust not just fares but even bag fees dynamically, showing how deep learning is starting to power real-world, individualized pricing strategies.

Data Sources & Signal Engineering

Dynamic pricing lives or dies on data and continuous learning. The strength of a deep learning model depends on the variety and quality of signals it can learn from. In travel and hospitality, those signals are rich, fast-changing, and often surprising.

Here’s how market leaders are engineering signal pipelines that actually move revenue:

Transactional signals:

Bookings, cancellations, no-shows, and historical price calendars. These form the baseline for demand patterns and elasticity.

Distribution signals:

Direct bookings vs. OTA/metasearch share, competitor rate snapshots, and GDS/PNR feeds. These help track channel performance and price positioning.

Digital behavior signals:

Search queries, user session flows, and loyalty tier data. These reveal intent and customer value in real time.

External demand signals:

Event calendars, weather shifts, regional macro indicators, and even social sentiment. These anticipate demand surges or dips before they’re visible in booking data.

Cadence matters:

The real-time or streaming data keeps pricing decisions aligned with live market shifts. Batch updates still play a role for nightly recalibrations and longer-range forecasts.

Data quality and labeling:

The elasticity isn’t in the raw data; it has to be inferred. Historical price changes, paired with demand response, become the training ground for these labels. Cleaning, deduplicating, and standardizing inputs is what separates a model that predicts well from one that drifts fast.

Modeling Approaches: Deep Learning Toolbox Uses

No single model wins across every pricing scenario. Each approach shines in different contexts:

1. Time-series + Deep Learning

- Models like Transformers, temporal convolution networks, and LSTMs dominate demand forecasting.

- They capture seasonality, day-of-week effects, and shifting booking curves better than classical ARIMA.

- When hotels applied advanced time-series models, they reported up to 12–15% gains in forecast accuracy compared to legacy tools (Skift Research, 2024).

2. Hierarchical models

- Perfect for inventory-based products like rooms, seats, or car rentals.

- They respect capacity constraints and capture dependencies across categories (e.g., room type → property → region).

- Airlines using these saw a 5–7% revenue lift by aligning fleet-level and route-level forecasts.

3. Causal models/uplift modeling

- Essential for measuring price elasticity while controlling for confounding factors.

- Instead of just seeing correlation, you estimate the true effect of a price change on demand.

- Companies that introduced causal frameworks reduced mispricing errors by nearly 20% year-over-year.

4. Reinforcement Learning (RL) & contextual bandits

- Suited for continuous, adaptive pricing in high-frequency environments.

- RL agents learn by exploring pricing actions, balancing experimentation with profit.

- Online travel agencies applying bandits saw conversion improve by 8–10% within a single quarter.

5. Hybrid Architectures

- Forecasting + constrained optimization is where most enterprise systems are heading.

- A forecasting model predicts demand, while an optimization layer enforces rules (min/max prices, competitor positioning, or fairness).

- This approach helps leaders unlock consistent RevPAR growth without breaking brand trust.

Evaluating models goes beyond accuracy:

- Revenue lift in A/B tests is the north star.

- Predicted RevPAR and conversion rates are tracked alongside price elasticity estimates.

- Cancellation-adjusted revenue is becoming standard, ensuring models optimize for realized value.

- Fairness and bias metrics matter more as regulators scrutinize algorithmic pricing.

Deep Learning Architecture & Runtime

Once the model is trained, the challenge is moving from predictive data to an actual price a customer sees. That’s where runtime architecture matters.

1. Real-time inference layer

- Data flows from a feature store into the model, which generates a demand forecast or elasticity signal.

- A pricing policy then converts this into an actionable rate, with guardrails in place, the min/max thresholds, brand rules, or competitor alignment.

- This ensures prices remain profitable, competitive, and aligned with brand reputation.

2. MLOps considerations

- Modern leaders don’t ship models blindly. They use model versioning to track updates, shadow testing to validate outputs without customer exposure, and canary rollouts to introduce changes gradually.

- Offline simulations help stress-test models across historical data before they go live.

- This reduces the risk of pricing errors and protects revenue.

3. Scale and latency

- Travel is a high-speed market. For metasearch and direct booking engines, inference needs to happen in sub-second latency.

- For OTA rate updates, updates can happen in near real-time, typically within minutes.

Leaders like Expedia and Booking.com are already operating with these benchmarks in 2025.

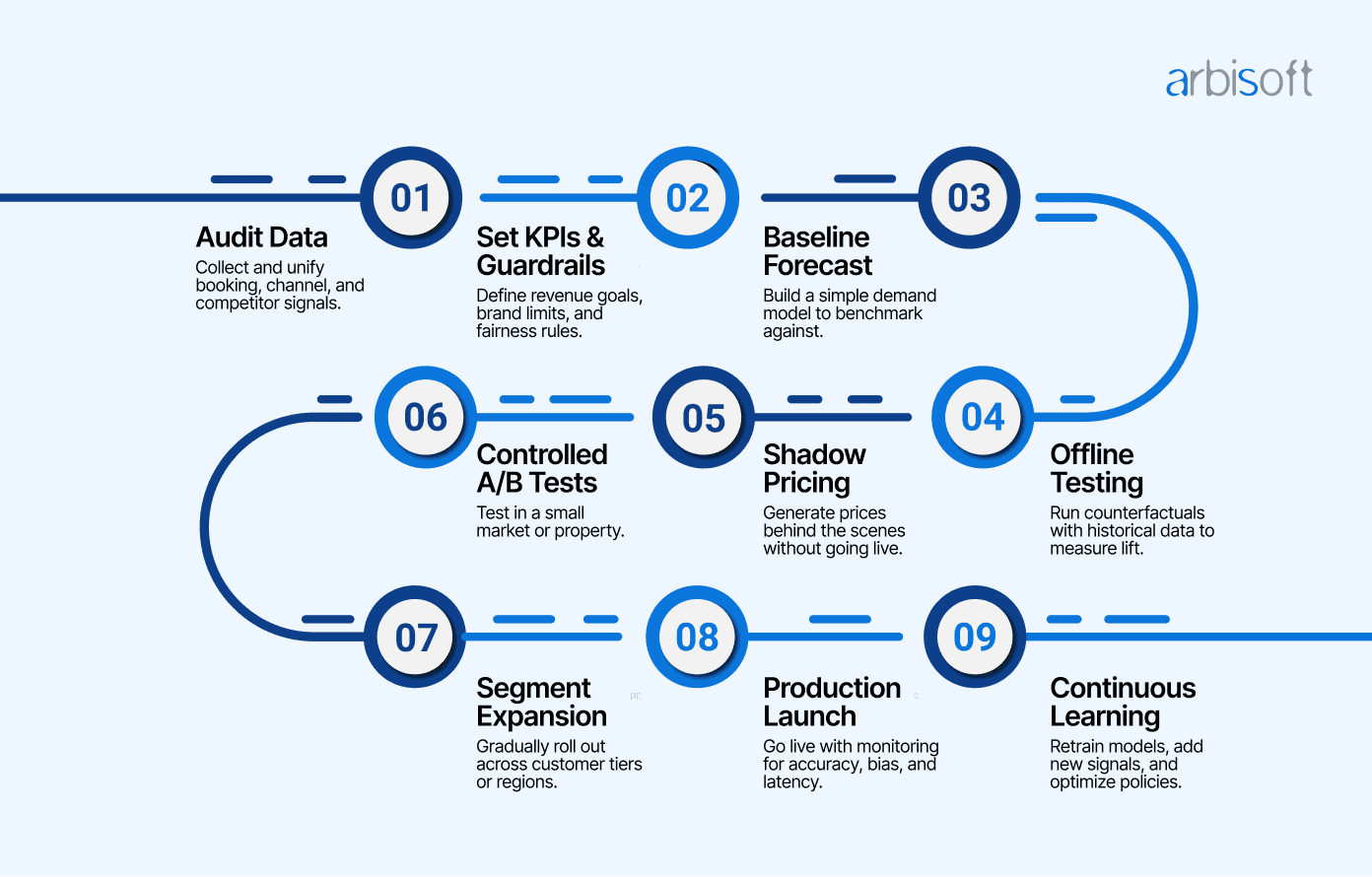

9 Steps to Deploy Dynamic Pricing

Deploying deep learning for dynamic pricing is about disciplined execution. Market leaders follow a structured rollout playbook that balances innovation with control:

KPIs & Experimentation Plan

Dynamic pricing only works if you can prove impact. Market leaders in 2025 are shifting from vanity metrics to evidence-based KPIs and structured experiments that tie pricing directly to revenue, trust, and long-term loyalty.

Here’s a simple table you can adapt:

| KPI | Why it matters | How to measure |

| Incremental Revenue (primary) | Core measure of business impact. AI-driven pricing should consistently deliver uplift beyond static rules. | Compare treatment vs. control groups in A/B tests. Track uplift percentage vs. baseline. Industry leaders see a 5–10% lift after full rollout. |

| RevPAR (Revenue per Available Room) (primary) | Hotels rely on this as a core benchmark of yield efficiency. | Track RevPAR shifts across test and control properties, adjusted for seasonality. |

| Conversion Rate Lift (primary) | Shows if new prices attract more bookings without over-discounting. | Session-level A/B tests on booking funnels. Report lift in % terms. |

| Churn / Retention (secondary) | Dynamic pricing should not drive loyal customers away. | Loyalty program data, repeat booking rates, and cohort analysis. |

| Customer Complaints & Perceived Fairness (secondary) | AI-driven pricing can spark backlash if seen as unfair. | Monitor NPS, surveys, review sentiment, and complaints tied to pricing. |

| Cancellation-Adjusted Revenue (secondary) | Avoids “phantom gains” from bookings that never materialize. | Measure net revenue after cancellations and rebookings. |

Experimentation best practices:

- Run shadow tests first, then progress to A/B pilots in smaller markets.

- Use multi-metric scorecards (not just revenue) to avoid short-term wins that hurt trust.

- Ensure statistical power with enough booking volume before declaring success.

- Integrate fairness and bias metrics — now a board-level concern in travel pricing.

Closing Thoughts

The key for market leaders isn’t just choosing the right KPIs, but running experiments that prove business impact in weeks, not years. Start with hard metrics like incremental revenue, RevPAR, and conversion lift. Balance them with guardrail metrics like churn, cancellations, and fairness to protect long-term trust. When revenue growth and customer confidence move in the same direction, you know your dynamic pricing strategy is working and ready to scale.

Looking ahead, the next two to three years will bring tighter customer scrutiny, stricter regulatory oversight, and new competitive pressures. Companies that treat KPIs not as a scoreboard but as a continuous learning system will be the ones setting pricing standards, not reacting to them. The winners will redefine what fair, personalized, and profitable pricing looks like in travel and hospitality.