We put excellence, value and quality above all - and it shows

A Technology Partnership That Goes Beyond Code

“Arbisoft has been my most trusted technology partner for now over 15 years. Arbisoft has very unique methods of recruiting and training, and the results demonstrate that. They have great teams, great positive attitudes and great communication.”

How Fraud Detecting AI Agents Help Fight Smarter Scams

The world’s biggest heist isn’t happening in dark alleys or high-security vaults — it’s unfolding online. Fraudsters are using flawless grammar, cloned voices, and videos of people who don’t even exist to trick both financial institutions and customers.

The result? A staggering $2 trillion is lost every year.

Traditional fraud detection methods, such as flagging poor spelling or blurry fake IDs, are now obsolete. The game has changed. And to win, financial institutions need more than automation. They need AI agents that are intelligent, autonomous systems that hunt down fraud in real-time.

This blog will walk you through what AI agents are, how they evolved, and why building task-specific AI agents is becoming the most powerful line of defense in financial crime prevention.

How AI Agents Help Prevent Financial Crime

AI agents represent a significant advancement beyond traditional artificial intelligence systems. Unlike conventional AI that primarily assists human operators, AI agents are sophisticated systems capable of autonomous decision-making and task execution within defined parameters.

These agents can independently analyze transactions, investigate suspicious patterns, and even take predetermined actions to mitigate risks. All of this happens with appropriate human oversight. Unlike static automation, these AI agents can scale reliably, too.

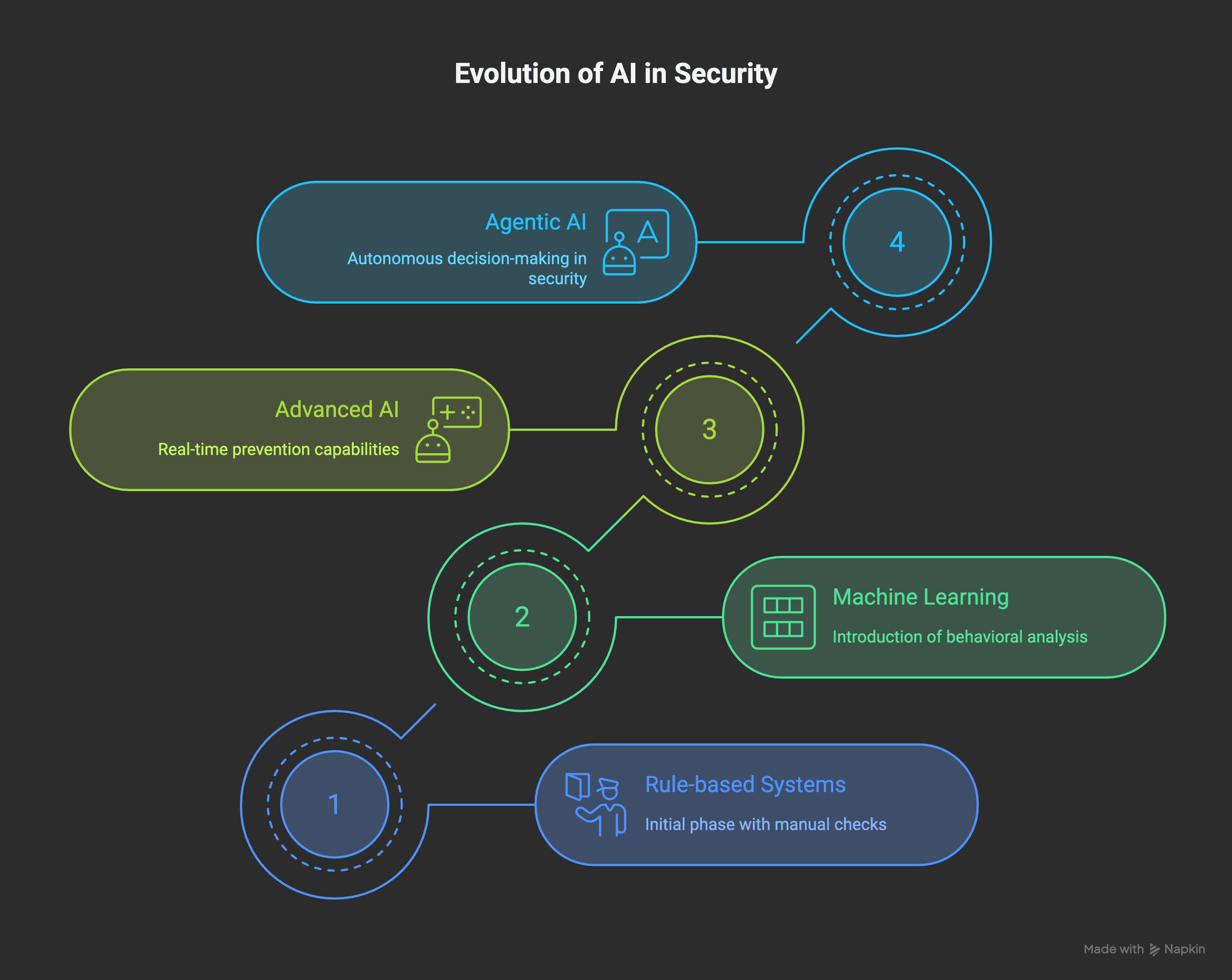

The evolution of AI in financial services has followed a clear trajectory:

Phase 1: Rule-based systems and manual reviews

Phase 2: Machine learning and behavioral analysis

Phase 3: Advanced AI and real-time prevention

We've now entered Phase 4: The age of agentic AI, where autonomous systems don't just recommend actions but execute complete processes from detection to resolution.

Types of AI Agents in Fraud Detection

Let us take a look at the types of AI Agents in Fintech for crime prevention.

Agent Type | Primary Function | Key Capabilities | Use Cases |

| Analytical AI | Pattern recognition and anomaly detection | Machine learning, predictive analytics, behavioral analysis | False positive reduction, transaction monitoring AI, risk scoring |

| Generative AI | Content creation and data synthesis | Natural language processing, deep learning, synthetic data generation | Report generation, customer communication analysis, document processing |

| Agentic AI | Autonomous task execution | End-to-end process automation, decision-making, adaptive learning | Client onboarding, alert investigation, case closure |

Let’s look at them on a deeper level:

Analytical AI

Analytical AI forms the foundation of modern fraud detection systems. These systems excel at processing vast datasets to identify patterns and anomalies that might indicate fraudulent activity. They've proven particularly effective in reducing false positives in controls. This can include transaction monitoring AI, sanctions detection, and name screening.

These systems use sophisticated algorithms like gradient boosting and random forests to detect subtle signs of AI fraud that would escape traditional rule-based systems.

Generative AI

Yes, fraudsters can use Generative AI to create scams. But financial institutions are now fighting fire with fire.

Generative AI is brilliant at quickly understanding massive amounts of information, whether it's neatly organized data or messy documents.

Here’s what it actually does:

- Digs through documents to find key details in seconds.

- Summarizes long, complex cases into short briefs.

- Helps write reports on suspicious activity, saving investigators hours of paperwork.

By automating these time-consuming tasks, Generative AI lets human experts focus on what they do best: making critical decisions. When used responsibly, it makes the entire process of catching fraud faster and more efficient. And that is where AI tools in software QA come to work.

Agentic AI

Agentic AI represents the most advanced category. It can make suggestions and can autonomously complete entire tasks from start to finish.

What does that actually look like?

Instead of just flagging a problem, an Agentic AI system can:

- Onboard a new client by itself.

- Run continuous background checks (KYC).

- Investigate a fraud alert and close the case without human help.

This is a game-changer for scale. A single human manager can oversee 20 or more of these AI agents, boosting team productivity by 200% to 2,000%. This means experts can focus on the toughest cases while the AI handles the routine work.

Building Your AI Agent Framework: Start with a Solid Base

Think of building your AI system like building a house. You need a strong foundation and good materials to make it work. For AI, that foundation is a flexible and scalable tech setup. This means having:

- Powerful AI models to do the thinking.

- A framework that lets your AI agents work together.

- Connections (APIs) to all your data sources, both inside and outside your company.

- Enough computing power to handle it all.

The smartest approach? Don't replace everything you have. Build your new AI capabilities on top of your existing systems where you can.

Here's the biggest open secret in AI. 87% of financial institutions say bad data is their #1 problem. An AI is only as smart as the data it learns from.

You can fix this by focusing on three things:

- Data Unification: Break down the walls between your data. Combine transaction history, customer info, and device data to get a complete 360° view of risk.

- Data Quality: Use AI to clean up your data! It can automatically find errors, fill in missing info, and keep everything accurate.

- Entity Resolution: This is just a fancy term for making sure your AI knows that "Rob Roberts," "Robert Roberts," and "Bob Roberts" in different systems are all the same person. Getting this right is crucial for accurate monitoring.

The Implementation

But even the most powerful AI is useless without the right team to guide it. That's your next move.

Assemble Cross-Functional Team

You can't do this alone. Your first step is to assemble a cross-functional dream team. You need a mix of:

- Data scientists and IT specialists who understand AI.

- People from customer service, legal, and operations who understand how things actually work day-to-day.

This combo ensures your AI solution is both technically brilliant and practically useful.

Build a Multi-Layered Defense

Don't just rely on AI alone. It will need multiple walls and lines of defense to make it actually work. Your strategy should layer AI with other proven tools like:

- Multi-factor authentication (MFA)

- Device fingerprinting

- Behavioral biometrics (how a user behaves while typing or scrolling)

This way, even if a fraudster gets through one layer, they'll be stopped by the next.

Hire Your Digital Employees

Now, "hire" specialized AI agents for specific jobs, just like you would people.

- The Research Assistant (RAG Agent): This agent finds and pulls all the relevant information your team needs from massive databases in seconds.

- The Data Manager (Data Pipeline Agent): This one's in charge of keeping data flowing smoothly and checking it for quality.

- The Analyst (Research & Analysis Agent): Its job is to gather intel from various sources, connect the dots, and write up the report.

- The Quality Inspector (Validation Agent): This agent double-checks everyone's work, ensures accuracy, and suggests improvements.

In the End

Now the AI agents don’t just recommend actions but take them. From analyzing data to onboarding clients, these “digital employees” are changing the fight against financial crime.

But while the tech is powerful, it’s only as strong as the foundation it’s built on: good data, the right framework, and a team that blends human expertise with AI speed.

In the next part, we’ll explore how banks can responsibly deploy these AI agents with strong governance, ethical practices, and future-ready defenses. Because in the race against AI-powered fraud, the institutions that adapt fastest will win.